For example, if your regular rate were $30 per hour and you lawfully took 20 hours of paid sick leave to self-quarantine based on the advice of a health care provider, you may recover $600 ($30 per hour times 20 hours) from your employer. As another example, if you were entitled to a state or local minimum wage of $15 and lawfully took 20 hours of paid sick leave for the same reason, you may recover $300 ($15 per hour times 20 hours). However, you may not recover more than the amount due under the FFCRA. If I am home with my child because his or her school or place of care is closed, or child care provider is unavailable, do I get paid sick leave, expanded family and medical leave, or both—how do they interact? You may be eligible for both types of leave, but only for a total of twelve weeks of paid leave.

You may take both paid sick leave and expanded family and medical leave to care for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons. The Emergency Paid Sick Leave Act provides for an initial two weeks of paid leave. After the first ten workdays have elapsed, you will receive 2/3 of yourregular rate of payfor the hours you would have been scheduled to work in the subsequent ten weeks under the Emergency and Family Medical Leave Expansion Act. For the following ten weeks, you will be paid for your leave at an amount no less than 2/3 of your regular rate of pay for the hours you would be normally scheduled to work. If you take employer-provided accrued leave during those first two weeks, you are entitled to the full amount for such accrued leave, even if that is greater than $200 per day. Please note that if your seasonal employees are not scheduled to work, for example, because it is the off-season, then you do not have to provide paid sick leave or expanded family and medical leave.

In this situation, the employer must pay the employee's full pay during the leave until the employee has exhausted available paid leave under the employer's plan—including vacation and/or personal leave . However, the employer may only obtain tax credits for wages paid at 2/3 of the employee's regular rate of pay, up to the daily and aggregate limits in the Emergency Family and Medical Leave Expansion Act ($200 per day or $10,000 in total). Assuming I am a covered employer, which of my employees are eligible for paid sick leave and expanded family and medical leave? However, if you employ a health care provider or an emergency responder you are not required to pay such employee paid sick leave or expanded family and medical leave on a case-by-case basis.

And certain small businesses may exempt employees if the leave would jeopardize the company's viability as a going concern. Wage theft can violate provisions of the Fair Labor Standards Act , which requires a federal minimum wage and requires employers to provide for overtime pay for people working over 40 hours per week. When employers fail to meet these requirements, employees may be owed wages. Even when employers withhold amounts that seem small, the stolen wages can add up. For example, if a worker earns a wage of $290 for a 40-hour week, withholding a half hour a day from the paycheck translates into a loss of more than $1,400 a year .

That could be almost 10 percent of a minimum-wage employee's annual earnings. If, however, an employee has used some or all paid sick leave under the Emergency Paid Sick Leave Act, any remaining portion of that employee's first two weeks of expanded family and medical leave may be unpaid. Wage theft is the illegal underpayment or non-payment of wages owed to workers. Evidence from surveys suggests that wage theft is common and costs workers billions of dollars a year. This transfer of money from low-income employees to business owners is unfair and worsens income inequality while harming workers and their families.

Wage theft most often occurs with low-income workers and undocumented immigrant workers. A study found that 26% of low-wage workers were paid less than the minimum wage and found that 76% of workers who worked more than 40 hours were not paid the legally required overtime rate. From this study, it was estimated that workers lose an average of $2,634 annually due to these wage violations.

In 2014, the director of the federal Labor Department's Wage and Hour Division stated that his agency had uncovered nearly $1 billion in illegally unpaid wages since 2010. He also noted that the victimized workers had been disproportionately immigrants. I hire workers to perform certain domestic tasks, such as landscaping, cleaning, and child care, at my home. Do I have to provide my domestic service workers paid sick leave or expanded family and medical leave? It depends on the relationship you have with the domestic service workers you hire.

Under the FFCRA, you are required to provide paid sick leave or expanded family and medical leave if you are an employer under the Fair Labor Standards Act , regardless of whether you are an employer for federal tax purposes. If the domestic service workers are economically dependent on you for the opportunity to work, then you are likely their employer under the FLSA and generally must provide paid sick leave and expanded family and medical leave to eligible workers. An example of a domestic service worker who may be economically dependent on you is a nanny who cares for your children as a full-time job, follows your precise directions while working, and has no other clients.

How do I compute my employee's average regular rate for the purpose of the FFCRA? As an employer, you are required to pay your employee based on his or her average regular rate for each hour of paid sick leave or expanded family and medical leave taken. The average regular rate must be computed over all full workweeks during the six-month period ending on the first day that paid sick leave or expanded family and medical leave is taken. The Department encourages employers and employees to collaborate to achieve maximum flexibility. May I take my paid sick leave or expanded family and medical leave intermittently while teleworking?

Yes, if your employer allows it and if you are unable to telework your normal schedule of hours due to one of the qualifying reasons in the Emergency Paid Sick Leave Act. In that situation, you and your employer may agree that you may take paid sick leave intermittently while teleworking. How do I count hours worked by a part-time employee for purposes of paid sick leave or expanded family and medical leave? A part-time employee is entitled to leave for his or her average number of work hours in a two-week period. Therefore, you calculate hours of leave based on the number of hours the employee is normally scheduled to work. If the normal hours scheduled are unknown, or if the part-time employee's schedule varies, you may use a six-month average to calculate the average daily hours.

And if there is no such agreement, you may calculate the appropriate number of hours of leave based on the average hours per day the employee was scheduled to work over the entire term of his or her employment. What six-month period is used to calculate the regular rate under the FFCRA when, for example, my employee takes paid sick leave, gets better, and then one week later, takes expanded family and medical leave? Or perhaps the employee takes intermittent leave throughout several months in 2020? In other words, do I have to determine and review a new six-month period every time my employee takes leave?

As an employer, you should identify the six-month period to calculate each employee's regular rate under the FFCRA based on the first day the employee takes paid sick leave or expanded family and medical leave. That six-month period will be used to calculate all paid sick leave and expanded family and medical leave the employee takes under the FFCRA. If your employee has been employed for less than six months, you may compute the average regular rate over the entire period during which the employee was employed.

This is because each day of closure or unavailability is a separate reason for leave, and thus you would not need to take leave for a single reason intermittently. As such, you would not need employer permission to take paid leave on just the days of closure or unavailability. However, you would still need to provide your employer with notice and documentation as soon as practicable.

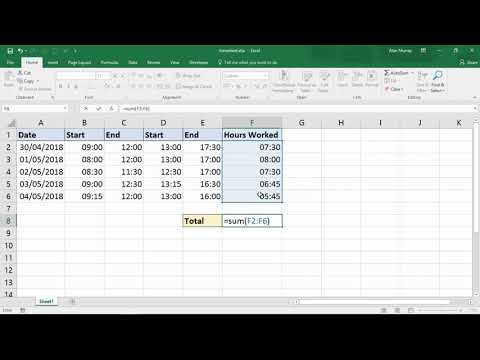

How To Figure Out Your Hours Worked The Department encourages employers and employees to collaborate to achieve flexibility. Therefore, if employers and employees agree to intermittent leave on a day-by-day basis, the Department supports such voluntary arrangements. Of course, to the extent you are able to telework while caring for your child, paid sick leave and expanded family and medical leave is not available. If, on the other hand, the domestic service workers are not economically dependent on you and instead are essentially in business for themselves, you are their customer rather than their employer for FLSA purposes.

Accordingly, you are not required to provide such domestic service workers with paid sick leave or expanded family and medical leave. Likewise, a day care provider who works out of his or her house and has several clients is not economically dependent upon you. May I take paid sick leave or expanded family and medical leave to care for my child who is 18 years old or older? Under the FFCRA, paid sick leave and expanded family and medical leave include leave to care for one of your children when his or her school or place of care is closed or child care provider is unavailable, due to COVID-19 related reasons.

This leave may only be taken to care for your non-disabled child if he or she is under the age of 18. Private sector employers that provide paid sick leave and expanded family and medical leave required by the FFCRA are eligible for reimbursement of the costs of that leave through refundable tax credits. If you intend to claim a tax credit under the FFCRA for your payment of the sick leave or expanded family and medical leave wages, you should retain appropriate documentation in your records. You should consult Internal Revenue Service applicable forms, instructions, and information for the procedures that must be followed to claim a tax credit, including any needed substantiation to be retained to support the credit. You are not required to provide leave if materials sufficient to support the applicable tax credit have not been provided.

As an employer, how do I know if my business is under the 500-employee threshold and therefore must provide paid sick leave or expanded family and medical leave? Workers who are independent contractors under the Fair Labor Standards Act , rather thanemployees, are not considered employees for purposes of the 500-employee threshold. Eligible workers who work more than 40 hours in one week must be paid one and one-half times their regular pay for every hour worked in excess of forty hours under the overtime pay requirements of Fair Labor Standards Act . Not receiving adequate compensation for extra work is an issue experienced by many workers, particularly by lower-income workers.

A 2019 study found that 13% of workers were not paid for hours worked outside of their usual schedule. When this group was broken down by income, the highest percentage of respondents were in the $15,000 to $19,999 bracket. When broken down by gender, 16% of women were not paid for their overtime work, while 9% of men were not paid for their overtime work. For more information about whether you are eligible for overtime pay, please see our site's overtime page.

If both state and federal overtime laws apply, the employee is entitled to whichever overtime protection is most strict and provides the most protection to you as an employee. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. Part-time employees are less likely to have these benefits.

I took paid sick leave and am now taking expanded family and medical leave to care for my children whose school is closed for a COVID-19 related reason. After completing distance learning, the children's school closed for summer vacation. May I take paid sick leave or expanded family and medical leave to care for my children because their school is closed for summer vacation?

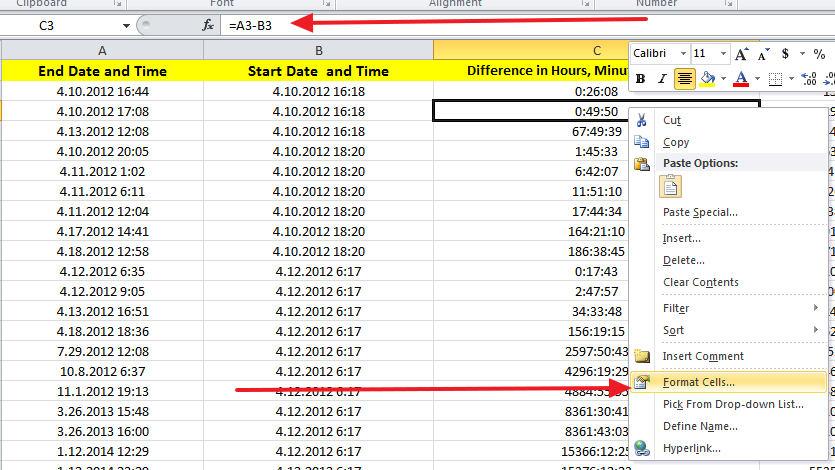

Paid sick leave and emergency family and medical leave are not available for this qualifying reason if the school or child care provider is closed for summer vacation, or any other reason that is not related to COVID-19. However, the employee may be able to take leave if his or her child's care provider during the summer—a camp or other programs in which the employee's child is enrolled—is closed or unavailable for a COVID-19 related reason. May I round when computing the number of hours of paid sick leave I must provide an employee with an irregular schedule or the number of hours I must pay such an employee for each day of expanded family and medical leave taken? It is common and acceptable for employers to round to the nearest tenth, quarter, or half hour when determining an employee's hours worked. But if you choose to round, you must use a consistent rounding principle. You may not, for instance, round for some employees who request leave but not others.

For the purposes of computing hours under the FFCRA, you may round to the nearest time increment that you customarily use to track the employee's hours worked. For instance, if you typically track work time in quarter-hour increments, you may round to the nearest quarter hour. But you may not round to the nearest quarter hour if you typically track time in tenth-of-an-hour increments. How do I compute the number of hours I must pay my employee who has irregular hours for each day of expanded family and medical leave taken?

Generally, under the FFCRA, you are required to pay your employee for each day of expanded family and medical leave taken based on the number of hours the employee was normally scheduled to work that day. The average must be based on the number of hours your employee was scheduled to work per workday divided by the number of workdays over the six-month period ending on the first day of your employee's paid expanded family and medical leave. This average must include all scheduled hours, including both hours actually worked and hours for which the employee took leave.

The only type of family and medical leave that is paid leave is expanded family and medical leave under the Emergency Family and Medical Leave Expansion Act when such leave exceeds ten days. This includes only leave taken because the employee must care for a child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons. May I take 80 hours of paid sick leave for my self-quarantine and then another amount of paid sick leave for another reason provided under the Emergency Paid Sick Leave Act? However, the total number of hours for which you receive paid sick leave is capped at 80 hours under the Emergency Paid Sick Leave Act.

Can more than one guardian take paid sick leave or expanded family and medical leave simultaneously to care for my child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons? You may take paid sick leave or expanded family and medical leave to care for your child only when you need to, and actually are, caring for your child if you are unable to work or telework as a result of providing care. Generally, you do not need to take such leave if a co-parent, co-guardian, or your usual child care provider is available to provide the care your child needs. During that six-month period, the first employee worked 1,150 hours over 130 workdays, and took a total of 50 hours of personal and medical leave.

The total number of hours the employee was scheduled to work, including all leave taken, was 1,200 hours. The number of hours per calendar day is computed by dividing 1,200 hours by the 183 calendar days, which results in 6.557 hours per calendar day. The two-week average is computed by multiplying the per calendar day average by 14, which results in 91.8 hours. Since this is greater than the statutory maximum of 80 hours, the first employee, who works full-time, is therefore entitled to 80 hours of paid sick leave. May I use paid sick leave and expanded family and medical leave together for any COVID-19 related reasons? The Emergency Family and Medical Leave Expansion Act applies only when you are on leave to care for your child whose school or place of care is closed, or whose child care provider is unavailable, due to COVID-19 related reasons.

However, you can take paid sick leave under the Emergency Paid Sick Leave Act for numerous other reasons. Many states have laws that require employers to pay employees for all hours worked, and which require employers to pay employees at regular intervals, such as biweekly or semimonthly. These laws may impose penalties on employers who do not comply with the law, and may even provide for criminal prosecution. In states that have their own wage and hour laws (or if you are not covered by the federal law, you should contact the agency in your state which handles wage and hour/labor standards violations, listed on our site's state government agencies page. Ultimately, the question of economic dependence can be complicated and fact-specific. As a rule of thumb, but not ultimately determinative, if you are not required to file Schedule H, Household Employment Taxes, along with your Form 1040, U.S.

In this case, you likely would not be required to provide paid sick leave and expanded family and medical leave. If the worker is your employee for federal tax purposes, so that you are required to file Schedule H for the worker with your Form 1040, you will need to determine whether the worker is economically dependent on you for the opportunity to work. If you determine that the worker is economically dependent upon you for the opportunity to work, then you are likely required to provide that worker with paid sick leave and expanded family and medical leave. As an employee, may I use my employer's preexisting leave entitlements and my FFCRA paid sick leave and expanded family and medical leave concurrently for the same hours?

This would likely include personal leave or paid time off, but not medical or sick leave if you are not ill. May I take my expanded family and medical leave intermittently while my child's school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons, if I am not teleworking? [Updated to reflect the Department's revised regulations which are effective as of the date of publication in the Federal Register.]Yes, but only with your employer's permission. Intermittent expanded family and medical leave should be permitted only when you and your employer agree upon such a schedule.

Your employer is not required to provide you with FFCRA leave after December 31, 2020, but your employer may voluntarily decide to provide you such leave. The obligation to provide FFCRA leave applies from the law's effective date of April 1, 2020, through December 31, 2020. Any change to extend the requirement to provide leave under the FFCRA would require an amendment to the statute by Congress. The Consolidated Appropriations Act, 2021, extended employer tax credits for paid sick leave and expanded family and medical leave voluntarily provided to employees until March 31, 2021. However, this Act did not extend an eligible employee's entitlement to FFCRA leave beyond December 31, 2020. Of course, you are not required to provide paid sick leave or expanded family and medical leave for workers who are employed by a third party service provider with which you have contracted to provide you with specific domestic services.